BullionStar Review 2025: Investing in Precious Metals

- Velocity

- Aug 2, 2025

- 4 min read

Updated: Oct 18, 2025

For more than a decade, Singapore has quietly built a reputation as one of the safest jurisdictions in the world for precious metals storage. At the center of that movement is BullionStar, a private bullion dealer and vault operator that has become a trusted name among investors seeking to diversify into physical gold and silver.

Founded in 2012, BullionStar has processed tens of thousands of transactions for clients across more than 100 countries. Its model combines online bullion trading, vaulted storage, and an unusual degree of transparency in an industry that is often opaque.

At a Glance

Headquarters: Singapore

Founded: 2012 (origins 2009)

Vault Locations: Singapore, New Zealand, USA

Client Reach: 100+ countries, 34,000+ annual buy orders

Core Offerings: Gold, silver, platinum bars & coins; vaulted storage; BSP savings program

Cost-efficient, transparent, and jurisdictionally diversified

Full review follows.

What Is BullionStar?

BullionStar was founded in 2009 by Torgny Persson and Joakim Andersson as an informational website for bullion trading. In 2012, the launch of BullionStar Pte Ltd marked its transition into a full-fledged bullion dealer. Under the leadership of CEO Luke Chua, it has since grown into a global platform.

The platform is especially known for its zero-spread gold and silver bars, where the buy and sell price are identical—a rare offering in the precious metals market.

Headquarters & Vaults: Singapore (main office and vault)

Additional Vaults: Wellington, New Zealand & Dallas, Texas, USA

Pros & Cons

✅ Pros | ❌ Cons |

|---|---|

Three vault locations (Singapore, USA, NZ) | High minimum deposit (1,000 SGD/USD/EUR) |

Zero-spread gold/silver products available | No debit/credit card support |

Free 10g silver bonus on signup | Lacks live chat support |

Bullion Savings Program for cost-effective investing | |

Frequent discounts and promotions | |

Strong Transparency |

Is BullionStar Safe?

BullionStar is not regulated as a financial institution by the Monetary Authority of Singapore. However, its model of public auditing and third-party inspection has earned it credibility in the absence of formal regulation.

Live Audits: Verify holdings in real-time using your account number.

Third-Party Audits: Regular checks by Bureau Veritas.

Vault Photos: View images of your specific bullion in vaults.

2FA & PIN Protection: Secure login and transactions via Google Authenticator or SMS OTP.

Metals Available

Gold: Bars, coins, numismatics, jewelry

Silver: Bars, coins, numismatics, wafers, rounds

Platinum: Bars, coins

Trading Tools

BullionStar operates via its proprietary, web-based platform.

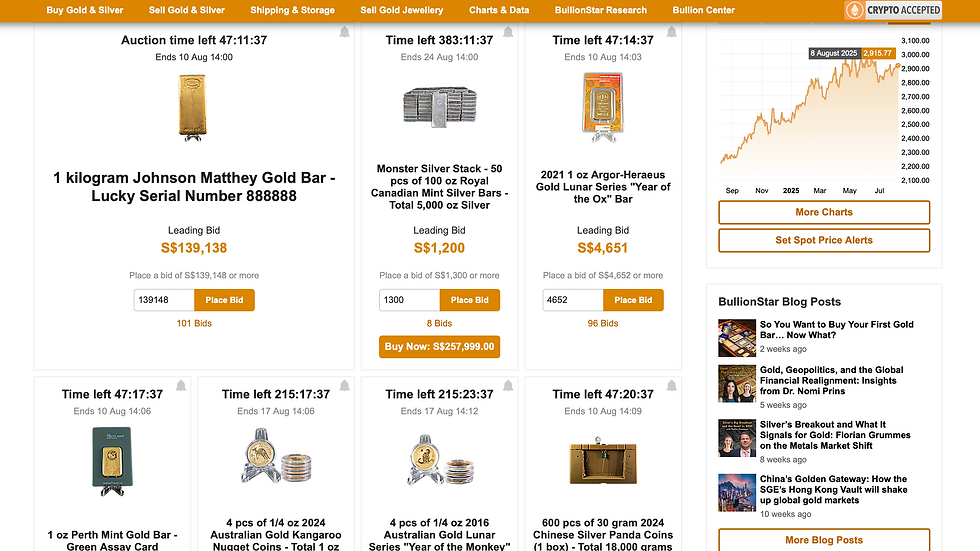

Live Price Charts: Track gold, silver, platinum, and palladium in USD, EUR, GBP, or even crypto like Bitcoin and Ethereum.

Market Alerts: Free notifications when a metal hits your target price per gram or troy ounce.

Portfolio Dashboard: Monitor profit/loss, balances, and holdings with clear visual breakdowns.

Note: While the platform offers live charts, it lacks advanced technical indicators, so serious traders may need external analysis tools.

Spot Trading

The core service is spot trading, where you buy directly from BullionStar:

For physical bullion sales, items must be delivered or shipped within 24 hours of order.

BullionStar Savings Program (BSP)

The program offers fractional ownership of gold, silver, and platinum starting from a single

gram. Storage fees are ultra-low and when enough metal is accumulated, it can be converted into physical bars without additional cost.

This program positions BullionStar not just as a dealer but as a hybrid between a bullion bank and a retail platform, giving it appeal to long-term savers and wealth planners. Key points:

Fees & Storage

Premiums on standard bullion products are competitive in the Singapore market, especially on 1kg bars and BSP holdings. The no-spread bars offer particularly efficient pricing for investors buying in size.

Storage Fees (Annual):

Singapore Vault: Gold 0.39%, Silver/Platinum 0.59%

Singapore BSP: Gold 0.09%, Silver/Platinum 0.19%

New Zealand Vault: Gold 0.59%, Silver/Platinum 0.88%

USA Vault: Gold 0.39%, Silver 0.49%

Minimum: SGD 0.19/day (~SGD 69.35/year per vault).

Price Premiums & Spreads

Premiums vary by product; e.g., 1 oz PAMP gold bar ~6.88%.

Some items, like 1kg spot gold bars, offer 0.4% premium with zero spread—ideal for cost-conscious investors.

Payments & Funding

Accounts can be funded in SGD, USD, or EUR via bank transfer. Singapore-based clients have the most options, including local bank checks and PayNow. For U.S. and European clients, funding is limited to wire transfers with a minimum deposit of 1,000 units in the chosen currency.

Withdrawals are straightforward and follow the same channels as deposits.

However, direct purchase can be made through multiple methods, including crypto.

Bonus: New users get 10g of silver via BSP to test the platform before committing funds.

Promotions & Offers

Auction Page Free 10g Silver: Automatically credited on signup.

Limited-Time Discounts: Regular offers on vaulted bullion at reduced premiums.

Referral Program: Earn commissions when friends sign up with your link.

Education & Research

BullionStar offers free resources through BullionStar Research and BullionStar University, covering topics like global gold markets, bullion banking, and investment strategies. A regularly updated blog features analysis from industry experts such as Ronan Manly.

So, Is BullionStar Worth It?

BullionStar remains one of the top platforms for trading gold, silver, and platinum. With a user-friendly interface, secure vaulting options, competitive storage fees, and unique zero-spread products, it’s well-suited for both beginners and seasoned investors. The free 10g silver bonus and Bullion Savings Program add extra value, while frequent discounts make it appealing for cost-conscious buyers.

Comments